16 January 2020

You may have seen a line in your development’s annual budget for contributions to the reserve fund – sometimes also referred to as the sinking fund – but what is this and why does it matter?

A reserve fund is money earmarked for large-scale or substantial building projects that are carried out to keep your development looking good and working correctly. We refer to these projects as ‘major works’ and these can include things like redecorating the outside of your building, repairing the roof or replacing communal windows.

The importance of paying into this fund is often overlooked. That’s understandable – it’s easy to justify paying for something that you can see needs doing immediately, but not so easy to rationalise putting money aside for jobs that may need to be done in the future.

What’s the benefit of a reserve fund for our customers?

We get told by our customers that the biggest benefit of having a reserve fund is the peace of mind that it brings. When you choose to live in a development with lots of other people, the costs of major works can be quite daunting. It’s not just a lick of paint over your own four walls that you have to consider, but the contribution you have to make to the upkeep of the communal areas that you share and enjoy with your neighbours.

A reserve fund gives you peace of mind that if a big job needs doing, you’re not going to suddenly get landed with a big bill, and you can get back to enjoying a home you can be proud of.

“Having a Reserve Fund has worked well in our block where many leaseholders live overseas. It is much more difficult and time-consuming to raise a one-off levy when lessees have to be contacted all over the world. It has also made it much quicker to get on with necessary major works. In addition, it makes budgeting much easier for leaseholders because it has never been necessary for them to contribute funds at relatively short-notice via a levy.”

London-based customer

What’s the benefit of a reserve fund for your development?

The reserve fund is there so that your development will always stay in the best possible condition. We want to increase the lifespan of the development for as long as we possibly can so you can enjoy your home for years to come. We can only achieve this by keeping up with regular maintenance and repair. By keeping the areas you share with your neighbours in great condition, we help to protect the value of the property too, should you ever choose to sell it.

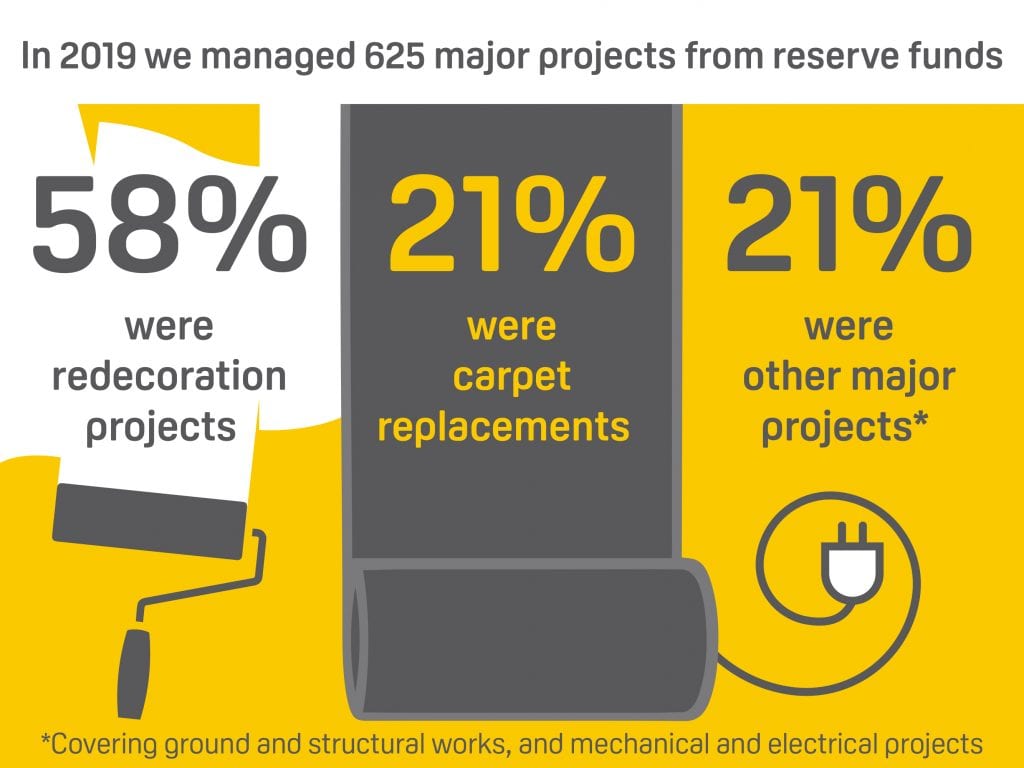

In 2019, we delivered 625 major works projects at developments we manage, funded by their reserve funds. Of these, 58% of these were redecoration projects (internal and/or external) and 21% were carpet replacement works (see below infographic). Both these types of projects are cyclical, meaning that they need to be scheduled over certain intervals to allow for wear and tear over time. This emphasises the point that a healthy reserve fund is essential when it comes to planning and implementing works that will keep your development looking its best.

“I have lived in central London apartment blocks since 1980. In my experience, all apartment blocks will sooner or later incur significant charges for items such as lift replacements, major renovations etc. These costs cannot be met from the normal annual budgeted service charge and in my view it is better to pay a few hundred pounds each year to build up Reserves to meet these expenditures, rather than have to pay a surcharge or a levy amounting to several thousand pounds when they occur, which they will.”

London-based customer

How do we manage the reserve fund?

The reserve fund goes into your dedicated development bank account. Like a club or a school, your building has its own bank account, which we set up and manage for you. You and your neighbours pay into this bank account to make sure there’s enough money to pay for the work your building needs. Any interest your money makes while it’s in the account belongs to your building.

How is the reserve fund different from the service charge?

For every service charge you pay, a portion of the money goes towards the reserve fund, but the two amounts account for very different things. The service charge you pay goes towards the day-to-day running costs of your development and is used to cover items such as buildings insurance, maintenance, repairs, gardening and communal facilities, as well as for any staff that might work at your development.

The reserve fund is collected to help contribute towards the cost of future non-annual costs like external redecorations, internal redecorations, carpet replacements or a lift replacement. Having money in your reserve fund means that when large projects like these come up there’s already money set aside to help fund them.

How is the reserve fund calculated?

The reserve fund is really carefully calculated based on an estimate of how much the works are expected to cost and when they are due to take place. We set out in the annual budget how much is being collected for the upcoming year. The money builds up over time, and the annual accounts we send you also show a statement of the overall amount saved in the reserve fund for your development. Any interest is credited to the reserve fund, and we’ll use this money in the future for other essential jobs.

Do you need to pay into a reserve fund if you’re planning to sell your property?

The reserve fund pays for works on the whole building and its grounds on behalf of all the residents. You and your neighbours all have a responsibility to pay into the reserve fund for the period you own your home, whether you plan to sell it or not. This will be written into the development’s lease.

If you decide to sell your property, the money you paid into the reserve fund will be kept as capital in the reserve fund to cover any repairs which have resulted from general wear and tear while you owned it. This means that future residents will avoid having to foot large bills for works which are required as the result of wear and tear over time. Having a healthy reserve fund in place should also make your property more attractive to a potential buyer and support the value of your home.